JPOS Payroll

All of your options in this screen will be located under the menu bar at the top

of your screen.

|

File

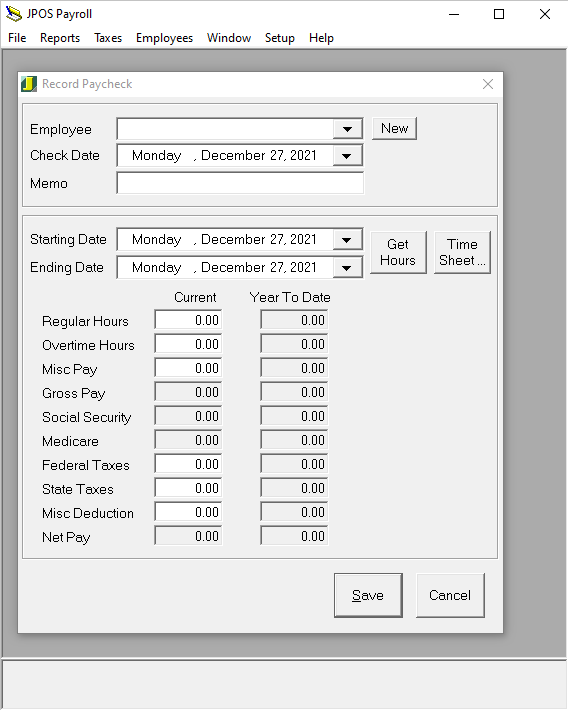

Record Paycheck- To record a paycheck for an

employee select "Record Paycheck" under the "File" menu. On

the screen that appears choose an employee, check date, and insert any memo you

may need. Then go down to the "Regular Hours" row and insert the amount

of regular hours the employee worked under the "Current" column. If the

employee had overtime hours insert those hours under the regular hours. If the employee

has anymore pay that needs to be accounted for i.e. a bonus, insert that in the

"Misc. Pay" box. All of the other fields will automatically be filled

out for you. The boxes under the "Year to Date" column will let show you

Current year totals. When your done filling out the paycheck press the "Save"

button. It will then ask you if you want to print the check.

Void Paycheck - This must be done from within

the JPOS Checking program.

Edit Employee Data- You can edit your employee

information from JPOS Payroll by clicking the "Edit Employee Data" selection

under the "File" menu. Doing this will bring a list of your employees

up on your screen. Select the employee you would like to edit by double clicking

the employee's name. This will bring up the "Employee Properties"

screen where you can modify employee information.

|

Back Up Files-

Print-

Exit-

Reports

Payroll Totals- To see what your payroll totals were for a particular day

or period choose the "Payroll Totals" selection under the "Reports"

menu. A screen will appear asking you to select a beginning date and an ending date,

once you have selected dates hit the "ok" button. Your report will appear.

To print the report you can either select "Print" under the "File"

menu or you can right click the report and choose print from those options.

Employee Records-

Taxes

Payroll/941/FUTA/SUTA Deposit- To see how much you need to deposit for a

particular day or period select the type of deposit you would like to see under

the "Taxes" menu. A screen will appear that will ask you for a beginning

date and an end date. After selecting those dates click "OK". The deposit

information will then appear.

Employees

New Employee- If you need to add a new employee you can do it from the JPOS

Payroll screen by selecting the "New Employee" option from the "Employees"

menu. A screen will appear that will ask you for all of the new employee's information.

Show Employees- If you would like to see a list of your current employees

select the "Show Employees" option under the "Employees" menu.

A screen will appear with a list of your current employees.

Setup

Check Layout- If you print your checks when you create them on JPOS you can

make sure the check layout is set up right by choosing the "Check Layout"

option under the "Setup" menu. After selecting this option a screen will

appear with all of the properties a normal check would have except they are moveable,

so if your fields are not printing out right on your checks you can adjust them

from this screen until you have adjusted them to the right spot.

Tax Rates/Constants-Click Set Federal Tax Rates and fill in the figures from

Federal Tax Rates. Click Set State Tax Rates

and fill in the figures from State Tax Rates.

To change a rate just click the corresponding rate, delete the rate currently shown

and enter the new rate.

Options- To choose what bank account and expense account your payroll will

be applied to choose the "Options" selection under the "Setup"

menu. A screen will appear that will ask you what account you want your payroll

to be taken out of, use the drop down arrow to see the list of accounts to choose

from. The next selection will be what expense account you want your payroll to be

applied to. Again, use the drop down arrow to see the list of expense accounts to

choose from. If you need to create a new account for either of the options just

click the "new" button to the right of the selection. When you are done

picking your accounts hit the "save" button.